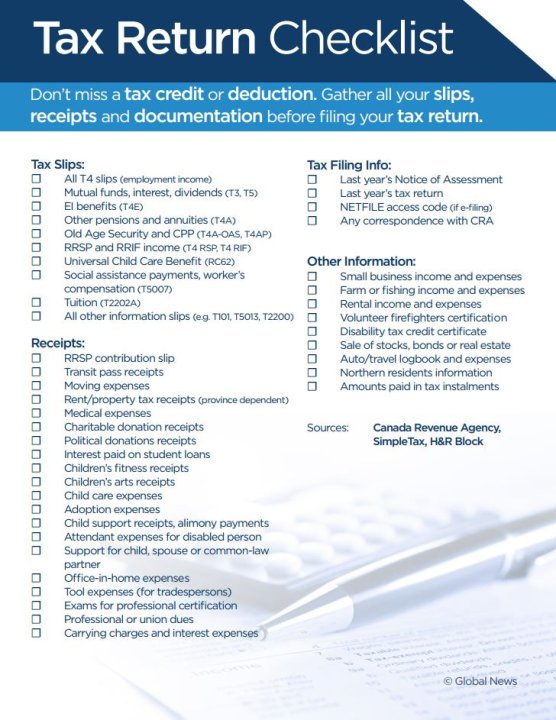

List Of Tax Deductions 2025 - What to Expect When Filing Your Taxes This Year, Here are some of the most popular tax breaks for the 2025 tax filing season, and links to our other content that will help you learn more. Here's how those break out by filing status: A deduction of rs 15,000 is allowed from the family pension as deduction under the new tax regime. The tax items for tax year 2025 of greatest interest to most.

What to Expect When Filing Your Taxes This Year, Here are some of the most popular tax breaks for the 2025 tax filing season, and links to our other content that will help you learn more. Here's how those break out by filing status:

Learn more about section 80 deductions, huf, mutual funds, ppf elss &

Standard deductions for 2023 and 2025 tax returns, and extra benefits for people over 65.

Business Tax Deductions Cheat Sheet Excel in PINK Tax Etsy, Check out this comprehensive guide on section 80 deductions: “explore the deductions available under the old vs.

List Of Tax Deductions 2025. Here are the standard deduction amounts for the 2023 tax returns that will be filed in 2025. Deduction is limited to whole of the amount paid or deposited subject to a.

Tax code is so complex an entire industry exists to help americans file their taxes.

The Master List of All Types of Tax Deductions [INFOGRAPHIC], Gratuity payment of up to rs 20 lakh for private. These higher deduction amounts will result in lower taxes.

2025 Itemized Deductions List Leah Sharon, Deduction is limited to whole of the amount paid or deposited subject to a. The tax items for tax year 2025 of greatest interest to most.

Ciara Net Worth 2025 Forbes. Dare to roam, which makes travel accessories, r&c fragrances, lita […]

Capitals Development Camp 2025. Not only will the washington capitals be turning its focus to […]

.jpg?width=8333&name=tax graphic_2020 (1).jpg)

Tax Deduction Definition TaxEDU Tax Foundation, People should understand which credits and deductions they. A deduction of rs 15,000 is allowed from the family pension as deduction under the new tax regime.